The new deadline for filing income tax returns in Malaysia is now 30 June 2020 for resident individuals who do not carry on a business and 30 August 2020 for resident individuals who do carry on a business. By 29 December 2018.

Tax Compliance And Statutory Due Dates For The Month Of November 2021

The company must submit e-CP204 for the.

. For GST-registered businesses to view or update contact information such as GST mailing address and to subscribe to email alert services for GST e-Filing reminder and GST Bulletins. FIRST TAXABLE PERIOD and FIRST RETURN and PAYMENT PERIOD for ODD FYE-Month for registration effective date on 1st September 2018. Submission 5 minutes Processing.

Also the MIRB has closed all its office premises until 14 April 2020 but is providing some limited services. That means any GST return is due within 30 days of the end of the reporting period. Businesses with annual turnover above RM5 million the frequency of filing is monthly.

And Claim input tax that was not claimed before 1 September 2018this is considered the final opportunity to claim input tax. If you are under special GST accounting periods the deadline to submit your returns is one month from the last date of the special accounting period. Input tax credit mechanism.

Remisi Penalti GagalLewat Bayar Dibawah Akta GST 2014. Business income e-B on or before 15 th July. The tax submission deadline under ITA is usually within 7 months after the end of accounting period.

Update GST Contact Details. Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year - L Co Social Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year 1. Any interest or penalties will not apply for businesses taking advantage of this extension.

1 April 2020 The Malaysian Inland Revenue Board MIRB has set out a new timetable for certain personal tax filing and employer compliance obligations including due date extensions in light of the COVID-19 crisis. More 37 09042021 Report To Be Prepared For Exemption under AMES. Update on Other Compliances.

Due date of GSTR 9 9A and 9C for FY 2018-19 is on 30th September 2020. 15th of the following month Sources from HRDCorp - refer to What happens if employer fails to make a payment. Companies are required to furnish estimates of their tax payable for a year of assessment no later than 30 days before the beginning of the basis period normally the financial year.

The amendment to the final GST-03 Return should be made would be allowable in the following situations subject to meeting conditions. Businesses have to charge and collect GST on all taxable goods and services supplied to the consumers. EVEN FYE Months 1st First Taxable Period 2 month 1st Taxable Period 1st September to 31st October 2018 Two months 2nd Taxable Period 1st November to 31st December 2018 Two months and so on.

Contribution Payment deadline. For more information about payment deadlines for annual filers see Remit pay the GSTHST instalments. Keeping of Records All GST registered businesses are required to keep their records for 7 years.

For Labuan entities taxed under the Malaysia Income Tax Act 1967 ITA the 3-months extension only applies to taxpayers whose accounting period ended on 30 November 2020 and 31 December 2020. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. All supplies of goods and services which are now subject to GST at standard-rated 6 becomes standard-rated 0 effective on 01 June 2018.

Jabatan Kastam Diraja Malaysia Kompleks. SST-02 SST-02A Return Manual Submission More 49 28102020 Sales Tax Service Tax Guide on Return Payment More 50 14102020. Only businesses registered under GST can charge and collect GST.

Deadline for filing of the GST Returns and payment of GST is the last day of the month following the taxable period. Was established on 2522019 and commenced business operation on 142019. Employment income e-BE on or before 15 th May.

The deadline for GST filing GST Returns and payment of GST is the last day of the month following the taxable period. Your entitys tax reference or GST registration number eg. Importation of goods is also subject to GST at standard-rated 0.

Malaysia announced the abolishment of its Goods and Services Tax GST effective from 1 June 2018. What does the MOF statement dated 16 May 2018 relate to the imposition of GST at 0 and its impact on GST. For the first time since 1957 the ruling partys political power was handed over to the opposition coalition Pakatan Harapan PH by the 14th general election held on 9 May 2018.

The monthly instalment payment will begin on the 6th month of the basis period for the Year of Assessment 2019 which is from September 2019 to May 2020. 200312345A or M90312345A Your Singpass. Businesses are allowed to claim whatever amount of GST paid on the business inputs by offsetting against the output tax.

Tax payable under an assessment upon submission of a tax return is due and payable by the last day of the seventh month from the date of closing of accounts. Kindly note due dates of GSTR 5 6 7 and 8 for the month of June 2020 is extended to 31st August 2020. Employment income BE Form on or before 30 th April.

The deadlines for the May to June 2021 quarter have been moved from July 31 to August 31. This was implemented in 2015 but then withdrawn in 2018 and the Sales and Services Taxes re-implemented. For further information kindly refer the Return Form RF Program on the.

Report all supplies made in the last taxable period and pay the GST due and payable relating to those supplies. Special accounting periods Penalties for late filing and late payment Penalties will be imposed if you are late in filing your GST return and making payment. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

Example if the taxable period is January to March then the deadline for filing and GST payment shall be 30 April. Form EA Annual income statement prepared by company to employees for tax submission purpose Deadline. The deadline to submit assessment statements for companies that must register for the Goods and Services Tax GST has been extended to June 15 without any penalty Royal Customs Malaysia Director for GST Datuk Subromaniam Tholasy said.

Business income B Form on or before 30 th June. Date of online submission may subject to change. The first accounting period ended on 30112019 8 months.

Accounting of output tax on tax invoice issued on or after 1 September 2018 for taxable supplies made during the GST era. More 38. The deadline for the return is no later than 120 days after 1 September 2018 ie.

According to the GST guides no GST adjustment is allowed to be made after 31 August 2020. Latest Malaysia VAT news. Filing can be done either by post or online.

Segala maklumat sedia ada adalah untuk rujukan sahaja. Also due date of ITC 04 for March 2020 and June 2020 quarter is extended to 31st August 2020. Different rules apply to most listed financial institutions that file annual returns and to all selected listed financial institutions.

Tax Compliance And Statutory Due Dates For April 2022 Ebizfiling

𝗧𝗮𝘅 𝗳𝗶𝗹𝗶𝗻𝗴 𝗗𝗲𝗮𝗱𝗹𝗶𝗻𝗲𝘀 𝗳𝗼𝗿 𝟮𝟬𝟮𝟭 Ks Chia Associates פייסבוק

Monthly Gst Filing In Malaysia Goods And Services Tax Gst

Preparing Vat Returns And Gst Returns Xero Blog

Gst Return Late Fees Interest On Gstr Late Payment

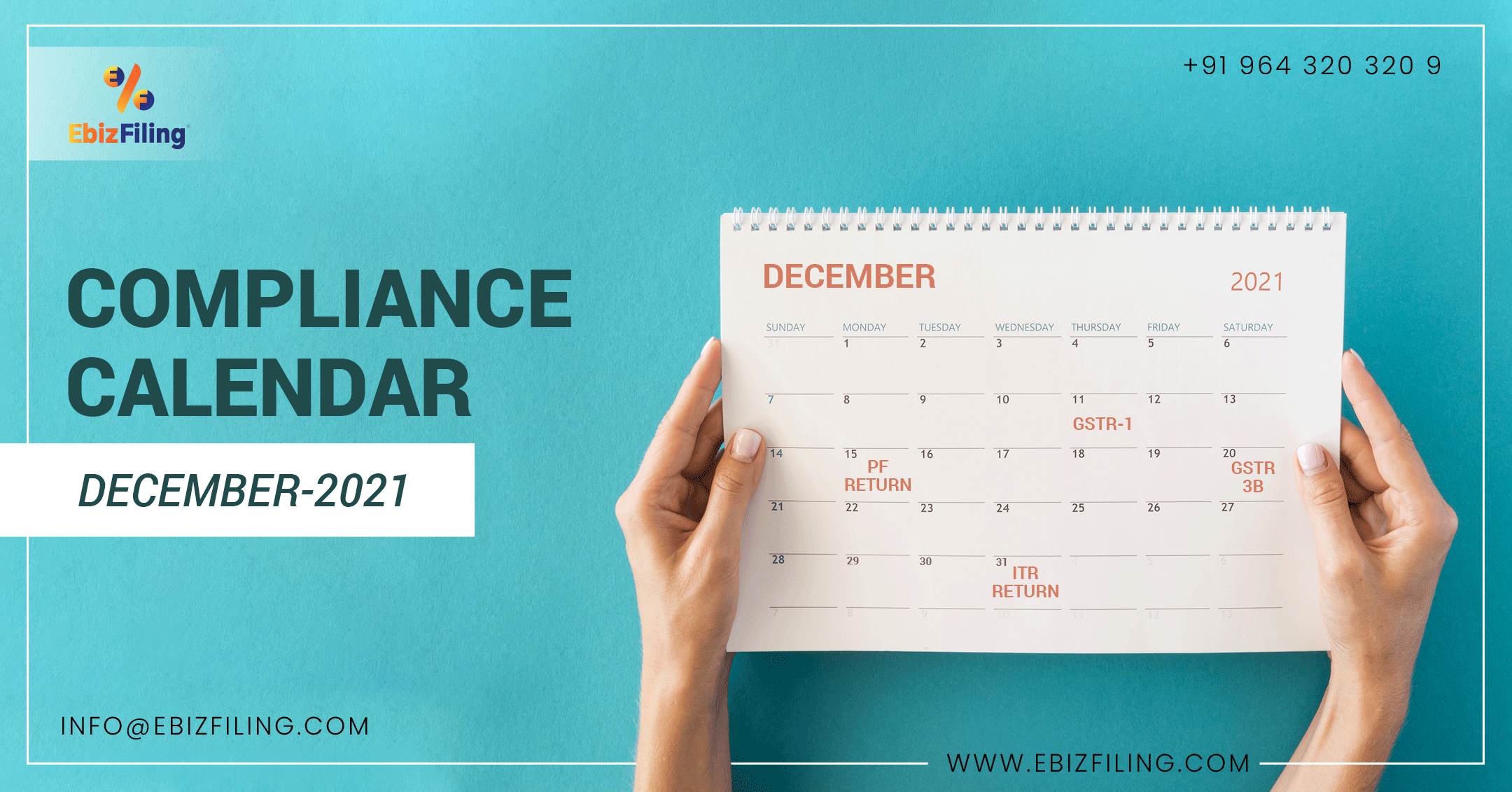

Tax Compliance And Statutory Due Dates For The Month Of December 2021

Monthly Gst Filing In Malaysia Goods And Services Tax Gst

Only 20 Of Gst Returns For Fy18 Filed A2z Taxcorp Llp

Iras Overview Of Gst E Filing Process

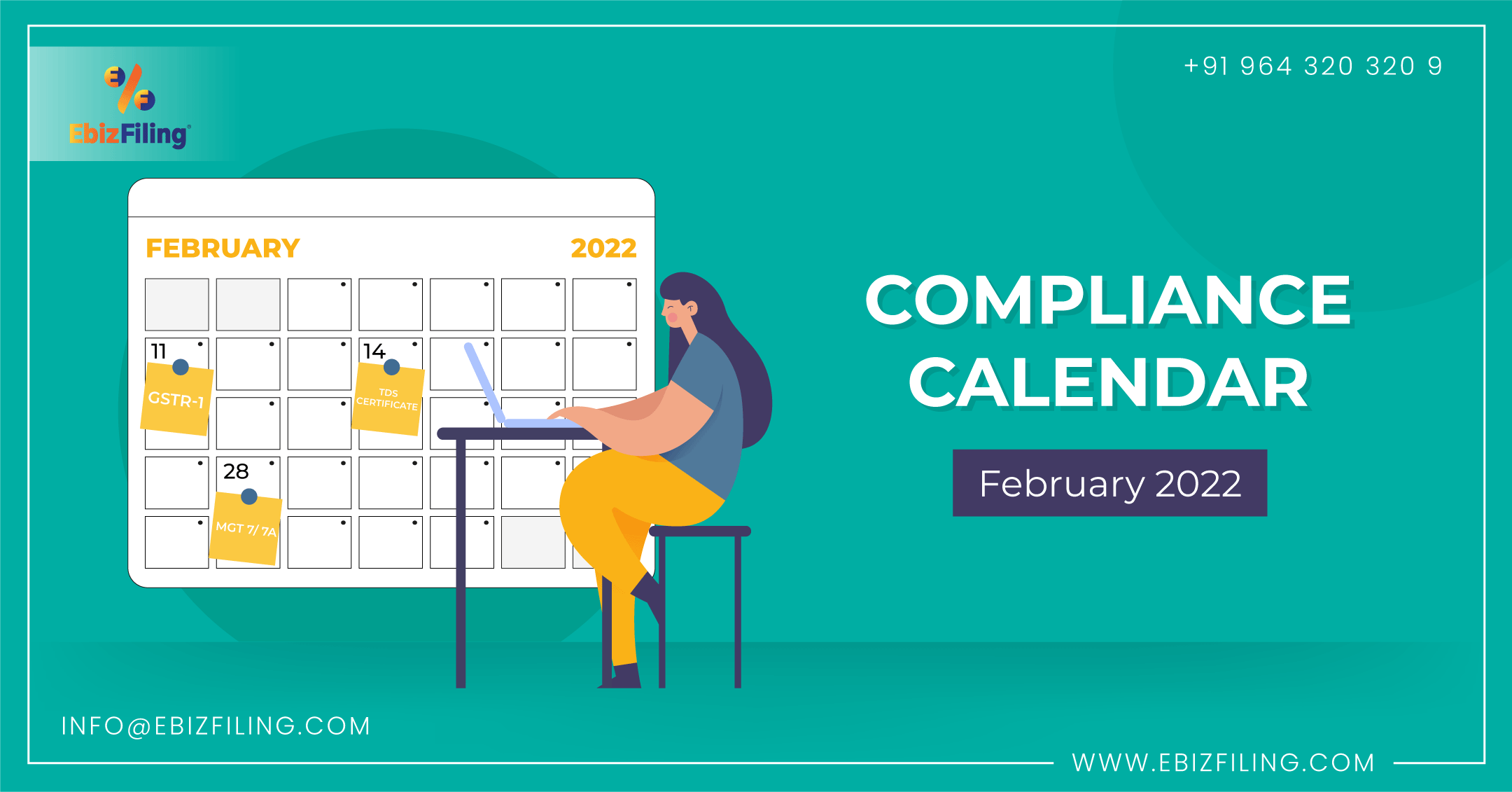

Tax Compliance And Statutory Due Dates For February 2022 Ebizfiling

Malaysia Sst Sales And Service Tax A Complete Guide

Extension Of Deadline 2 Months For Filing Malaysia Income Tax 2020

India Gst What Are The Different Types Of Gst Returns

Gst Requirements Penalties In Malaysia Klm Group Accounting Company Secretarial Taxation Audit Kuala Lumpur

Cbic Issues Standard Operating Procedure Sop For Gstr Scrutiny

Tax Compliance And Statutory Due Dates For The Month Of March 2021